Pionex Special Edition: Where is the Final Bottom?

2022 Cryptocurrency Market Analysis and Summary

Since 2022, the market has been affected by macro factors such as the Federal Reserve, inflation, the largest decline in bonds, U.S. dollar strength, and interest rates. The bear market seems to have no end. In this special weekly newsletter, we will analyze apparent trends and the current situation from financial logic to crypto market fundamentals, then outline our bottom price predictions.

What is happening now

1. The bond market continues to price the Fed’s aggressive interest rate hikes and the anchor for the global market—the 10-year U.S. bond yield is about to reclaim 4%, the level of the 2008 financial crisis. Bitcoin narrowly holds the $19,000 threshold.

2. The U.S. dollar index pointed to 120, hitting a 20-year high, putting pressure on all assets denominated in the U.S. dollar

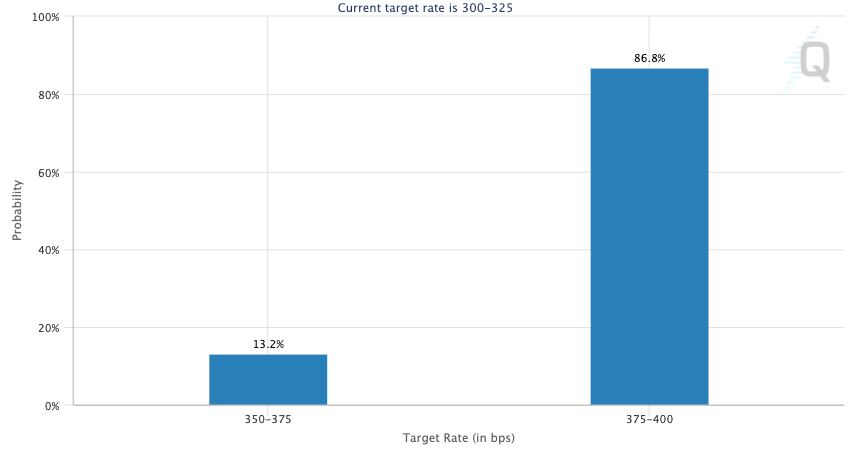

3. The market continues to price in the Fed raising interest rates, with a nearly 90% probability of raising interest rates by 75 basis points at the November meeting

What’s Gonna Happen Next

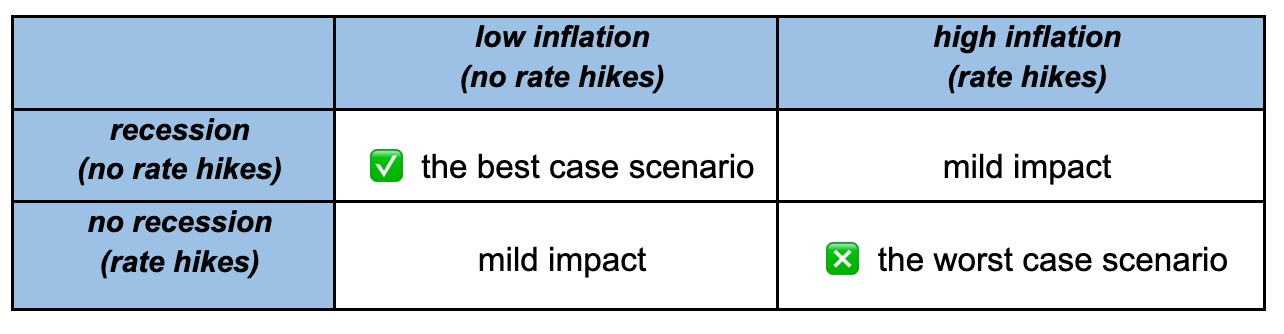

Fed’s policy

We have analyzed the multiple pressure constraints due to supply chain issues, major economies facing unprecedented inflation shocks, and the Fed's only tool to tackle inflation. Through our findings, even if we see inflation peaking shortly, it does not mean that the inflation problem has been solved. In other words, the United States may stay above the neutral inflation level of 2% for a long time. While the tightening policy and the potential recession expectations will be able to destroy demand, it does not solve supply-chain issues, thus preventing the Fed from truly exiting the tightening cycle. Risk assets will be re-priced due to inflation and policy expectations, and the market will suffer again.

Inflation

If the main cause of inflation is energy prices, then whether inflation continues to decline largely depends on the future price of energy.

On October 5, the OPEC meeting was held in Vienna, Austria, and the meeting decided to cut crude oil production by an average of 2 million barrels per day from November. According to historical data, this production cut will be the largest reduction since the pandemic, equivalent to about 2% of global oil demand, and the expiration may be extended to December 31, 2023.

Based on the mainstream market analysis, the crude oil supply cut will push oil prices above $100 per barrel. Goldman Sachs even raised its oil price target to $110 per barrel in Q4,2022.

The market gave the most real feedback: Oil prices have rebounded violently recently, and WTI crude oil has reclaimed its August level. High oil prices indicate that the high inflation problem in the United States may not be effectively solved, and the Federal Reserve has to continue to raise interest rates to fight inflation.

Correlation between US Stocks

Bitcoin and the U.S. stock market have shown a high correlation since early 2022. Rate hikes and QT will inevitably bring sour corporate earnings and consequent stock market selloffs, and it might bring a deeper correction to cryptocurrencies.

Goldman Sachs warned that the stock market could continue to tumble 25% if the Fed takes a more aggressive stance on rates to curb inflation.

Ray Dalio, the world's largest hedge fund, Bridgewater’s founder, recently warned that the U.S. stock market would plummet another 20% if interest rates rise to around 4.5%. In a newly published article, he wrote that interest rates might have to rise sharply to a range of 4.5% - 6%. This will cause slower private-sector credit growth and lower consumer spending, leading to a slowdown in economic activity.

Last Friday, due to a better-than-expected Nonfarm Payroll number, good news became bad. The panic sell-off across the board caused the whole market to tank. We believe that unless there is a large drop in this week's US CPI, which is significantly better than expected, it’s just a matter of time before the SPY falls below the previous low of $357. If the market continues to break the previous low and fall below the support range of $353 - $358, the next strong support may be around $319 - $323, we think there may be greater demand from buyers there. Therefore, unless there is good news from economic data or other fields, it will be difficult for $SPY to pull back above $353 - $358, and there is a high probability that crypto assets will continue to fall.

Instituional Sentiment

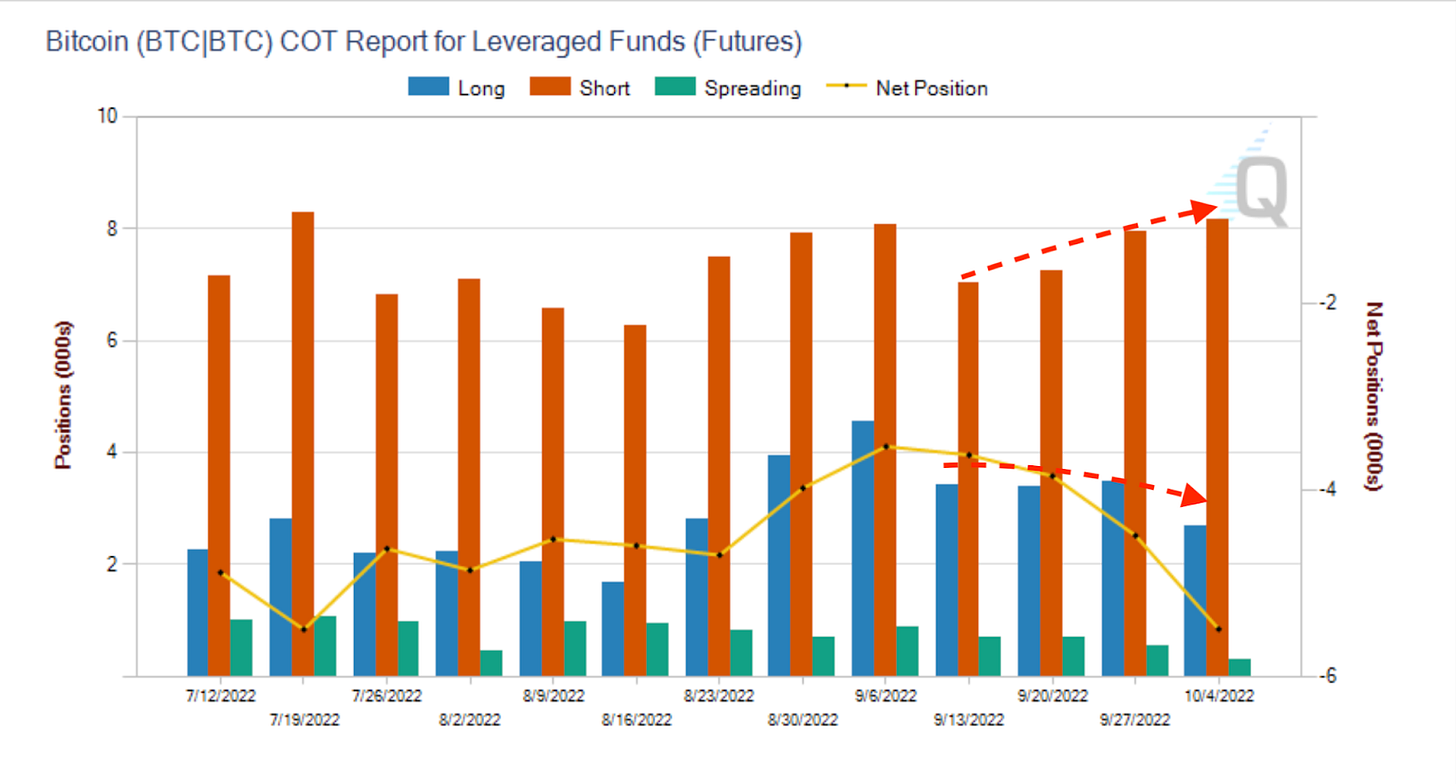

CFTC weekly report

According to data from U.S. Commodity Futures Trading Commission (CFTC) weekly report, speculators (smart money) such as hedge funds have recently increased their short positions in Bitcoin and reduced their long positions.

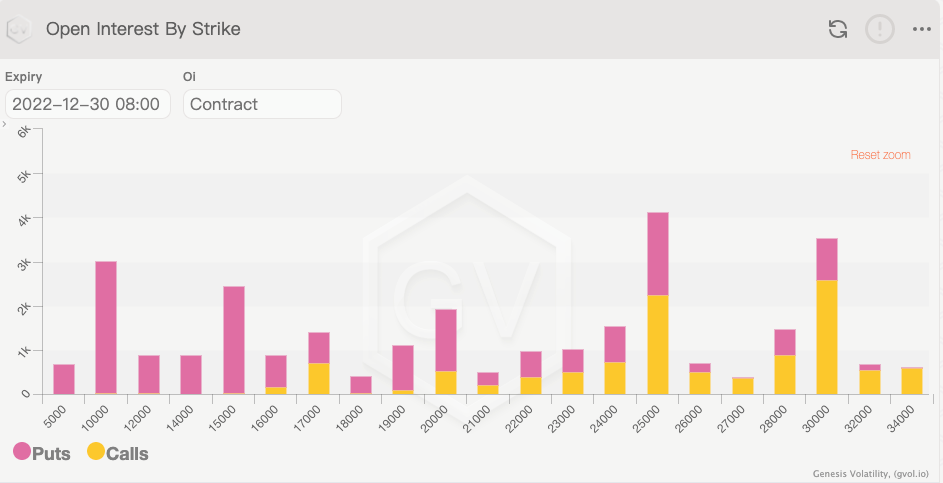

Options Contracts Show Bitcoin Will Drop to $10,000

Traders are now betting that bitcoin prices will fall down to $10,000, according to bitcoin options contracts expiring at the end of 2022 from crypto derivatives exchange Deribit.

Where Lies the Final Bottom?

How Long Will the Bottom Last

Bitcoin is down more than 70% from its all-time high and is currently hovering around $18,000 support. Some analysts, including the famous Doctor Profit on Twitter, believe that Bitcoin price has already entered a bottom phase at current levels. Compared with the 2014-2015 bear market, Bitcoin will bottom out until around March 2023. But we believe that the Fed and other central banks' decision to further raise interest rates, as well as global risks such as the Chinese economy and the Russian-Ukrainian war, are also important factors that will trigger big moves in the crypto market.

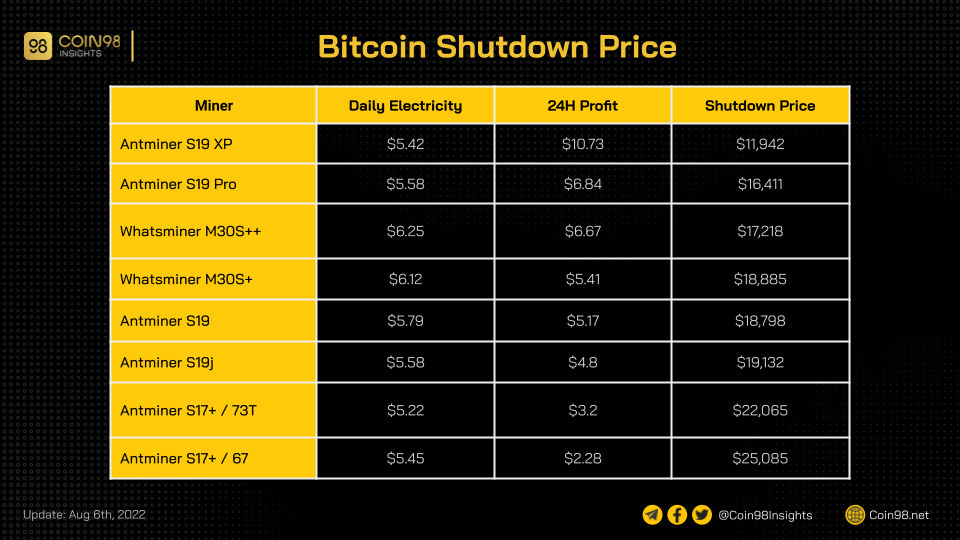

A Sneak Peek at Bitcoin Miner Shutdown Prices

According to the data provided by COIN98, we can see the recent shutdown prices from different models of mining machines. The shutdown price of BTC mining machines is a very important cost line and can also be used as a natural support level.

We mainly look at the shutdown price of several important price levels:

$22,000~$22,000 (10% of all machines are shut down)

$18,000~$19,000 (50%+ of all machines are shut down)

$12,000 (most machines are shut down)

Therefore, in terms of the shutdown price, $12,000 can almost be confirmed as the ultimate level that BTC cannot fall through.

BTC Technical Analysis

BTC daily chart shows a relatively obvious reverse “cup and handle" pattern. If the support range around $18,000~$18,600 cannot be held, the breakdown will bring it down to $15,000 first and then $11,800. Of course, it’s known to many investors that $12,000 is the shutdown price for many BTC miners.

To sum up, from both a technical point of view and supply-demand logic, the price of around $12,000 seems to be a fairly concrete historical bottom. But we prefer the market to reach the support range of $15,000~$16,000 and then bounce for a period of time before heading down to $12,000. However, in the crypto markets anything can happen, and there is always a chance we do not reach $12,000. This is why we recommend using our structured product with different target prices so you can reduce the cost of your positions while waiting.

Recommendation

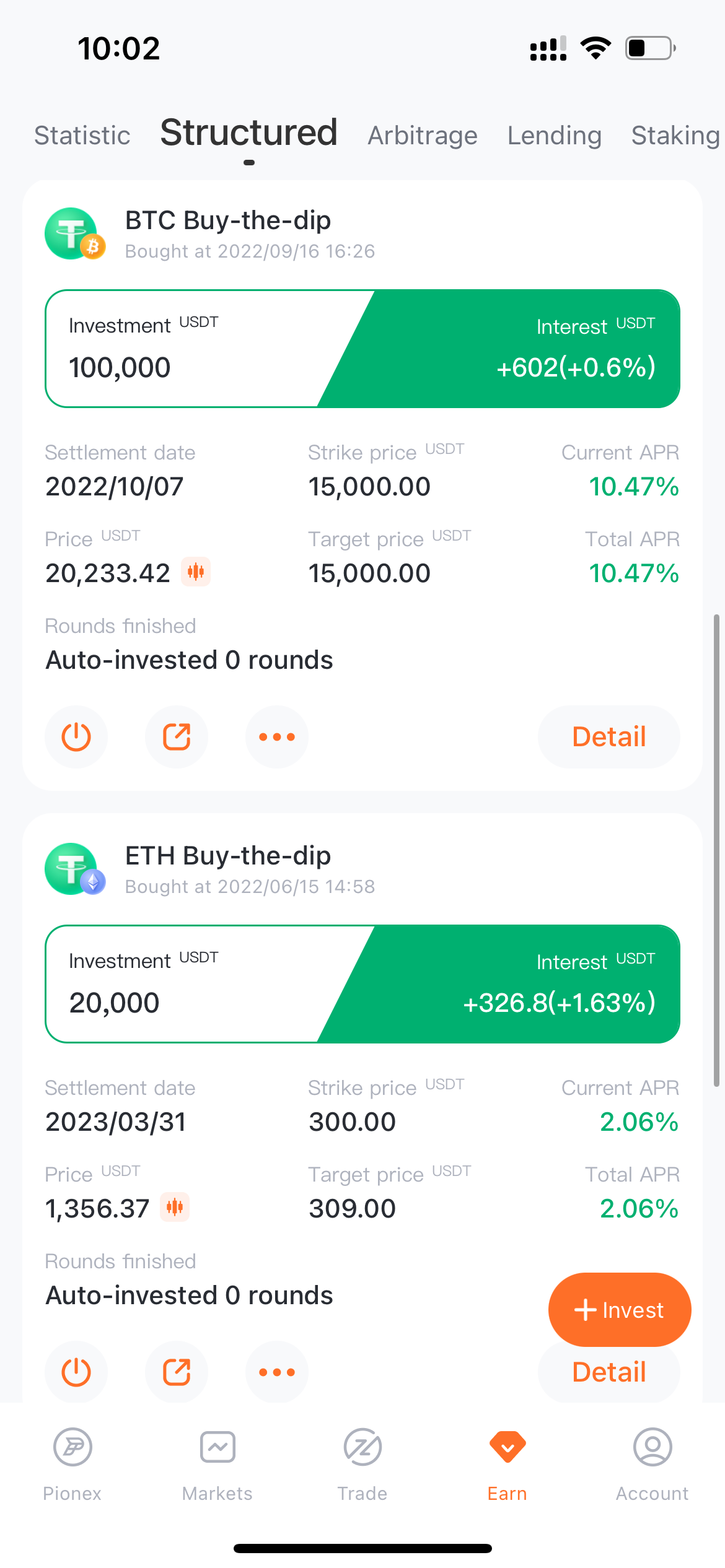

Buy-The-Dip Bot | Dual Investment

Although the price has never dropped to $17,500 ~ $18,000, as we suggested before, the APY of passive income can be as high as 40%, which can greatly reduce the cost of holding Bitcoin in the future.

For users holding USDT and still looking to buy BTC at reasonable prices, we recommend the short-term target range of $17,500 - $18,000, a period from 3 days to 10 days, and an APY of 35% ~70%.

If you are a long-term investor, I suggest you choose a product with a 45-80 days term, a target price of $15,000 ~ $16,000, and an APY of 10% ~ 25%. You can then input your parameters into the Buy-The-Dip bot for it to automatically roll your investment over until it is executed. Our goal is to buy and hold BTC at these prices for the long term. So if this doesn't align with your goals, please stick to your own idea.

Currently, the target price of $12,000 doesn’t provide enough yield, for the time being, so we do not recommend using structured products with a $12,000 strike price.

Other Structural Products

Now we are suffering from a lack of volatility in the market. If you don't have enough experience, it is extremely hard to generate profits right now. As such, it's best to use structured products to generate passive income while waiting.

For users who are holding USDT and hope to generate more profits, we recommend using the above-recommended dual investment product.

For users holding BTC and want a stable income, we recommend that you choose the BTC Covered Gain product. We believe it is almost impossible for BTC to easily break through the $22,000 resistance level in the short term, so we prefer to choose a target price of $22,000, with a 3-day to 10-day time period and 10% ~ 25% annualized income.

Swing Trades

BTC has been trading in a very tight range recently, and the volume has shrunk significantly. Given the US September CPI data is about to be released this week, although it can trigger large market fluctuations, we do not want to bet on this, and we do not provide any advice for manual trades this week.

Great information! Thanks for taking the time to research and share what you are seeing in the markets! ✨🙏🏼✨

thanks guys