Bitcoin Struggles on The Daily. This Altcoin Rally Has No Fundamental Support.

Weekly Crypto Market Research and Trade Ideas 11/13 – 11/20

Summary

Bitcoin struggles on the daily, but we wouldn’t recommend shorting. The trend is still bullish.

Altcoins driven by narrative with no fundamental improvements.

Fidelity files for an Ethereum ETF.

Balance on exchanges back at August highs.

The market's expectation of a rate cut may be too optimistic. We wouldn’t bet on a rate cut now.

Bitcoin supporter Javier Miei wins the Argentine presidency.

Technical Analysis

Bitcoin

On the monthly timeframe, we've successfully surpassed two solid monthly resistances in the past month. The powerful monthly candle demonstrated the strength of buyers, with everyone else on the sidelines. After the deceptive Cointelegraph BTC ETF approval news, we accurately captured the sidelined trader FOMO narrative in our research. However, the current question is whether we have enough momentum to breach and hold over the second monthly level between $35,000 and $36,000. If we manage to do so, it could resemble the trend seen in November 2020, characterized by consecutive monthly candles.

It's essential to acknowledge that the environment back then significantly differs from the present, emphasizing the importance of respecting monthly levels. This is not to convey a bearish outlook but rather to highlight a technical consideration: on the monthly timeframe, we have one week left to mold the candle into a more potent bullish form, or it might not present the most bullish outlook.

Zooming in on the lower time frames, it's evident that we're still in a pronounced uptrend, with each dip currently being bought. While we continue to track the trendline established last month, there are indications that it may be weakening as prices retraced more deeply into the 21-day EMA.

On the daily chart, increased volatility is apparent, marked by a substantial sell-off, a subsequent bounce, and a retest of the low. This suggests an ongoing struggle between bulls and bears, resulting in a lack of clear direction as we remain within the range of the "engulfing candle." This stands in contrast to earlier signs where large bullish candles had clear follow-through to the upside. While this indicates the onset of some weakness, it's not necessarily a signal to short or adopt an extremely bearish stance. The $34,000 - $35,000 zone is crucial and warrants close monitoring for building a position in Bitcoin. If this area is breached, we would recommend exiting any positions and waiting for a clear bottom, whether at $32,000, $30,000, or even lower.

Altcoins

We are seeing some strong Alts struggling and consolidating for the first time since the beginning of this rally. Notable examples include $SOL, $LINK, $RUNE, and $ORDI. Interestingly, while these strong altcoins consolidate, other smaller, less reputable Alts are getting the volume and attention. There are too many to mention individually, so we'll skip that part and suggest ranking them by the percentage gain on the day to see them.

It's advisable to exercise caution when pursuing these altcoins at the moment. The market is still predominantly Bitcoin-oriented, and without substantial fundamental developments, sustaining an altcoin rally might prove challenging. The fundamentals of many strong altcoins have not shown improvement; rather, their momentum is largely driven by narrative and FOMO.

Examining fundamental drivers such as TVL, users, and the developer community for $SOL and $AVAX reveals a decline. Both $SOL and $AVAX tokens, as well as stablecoins on-chain, are decreasing, a trend that ideally should be rising if the chain is actively used. It's crucial to understand that this altcoin rally differs from the one in 2020-2021, with varying demand and liquidity levels. Our recommendation is to go with the trend until a reversal occurs, marked by breaking the trend and taking out lows. A clear example illustrating this is $GAS and $YFI.

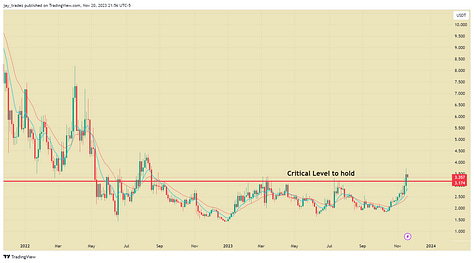

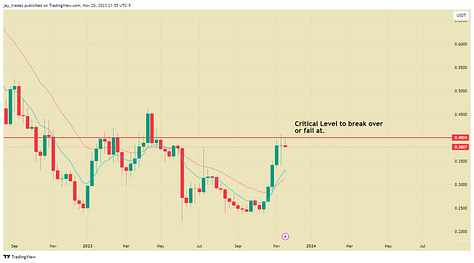

With that said, the rally can continue solely based on narrative, as we witnessed back in 2020 when many coins with no fundamentals experienced strong surges. Therefore, if Bitcoin continues its rally above $37,000, some altcoins at crucial levels that we favor include $AVAX, $ADA, and $SNX. We highlight these specifically because they are at critical levels that present favorable risk/reward entry points.

YFI

According to its CEO, DXDY suffered $9 Million in losses from market manipulation. One or multiple traders were able to dump large amounts of the coin and exit with stablecoins before any margin calls. Taking advantage of the large OI on DXDY.

News of the Week

Progress On Spot Bitcoin ETF

The U.S. Securities and Exchange Commission (SEC) has deferred its decision on Global X's spot bitcoin ETF filing. The original deadline for the SEC to take action on Global X was set for November 21st. However, due to this delay, the new deadline has been extended to February of the following year.

On the same day, the SEC also postponed its decision on Franklin Templeton's spot Bitcoin ETF. As of now, all deadlines for SEC decisions on spot Bitcoin ETFs have been rescheduled to 2024. The upcoming approval dates for mainstream institutions are concentrated between January 15 and 17, as indicated within the green box.

Macro analysis

Market Speculation on Rate Cut

According to data from CME’s FedWatch Tool, the market hype for a rate cut has reached extreme levels - traders expect the likelihood of a rate cut in March 2024 to have reached about 30%. Keep in mind that the US Q3 GDP growth rate is still as high as 4.9%, and the economic data has yet to show signs of a significant recession. We think the market's expectations for a rate cut are perhaps too optimistic, and it would not be wise to bet on a rate cut at this point in time.

Fundamental analysis

Stronger Liquidity

Our ongoing attention is directed towards on-chain indicators, specifically the amount of Bitcoin on of exchanges.

The amount of Bitcoin on exchange reflects the disposition of cryptocurrency holders in the market. An upward trend in balance on exchanges implies that holders are moving cryptocurrencies into exchange wallets, likely with the intention of selling for cash. This typically has a negative impact on prices. Conversely, a decline in exchange balance signals an increased willingness to hold for extended periods—a favorable scenario for any cryptocurrency.

From June to the end of October, Bitcoin balance on exchange consistently decreased, with a significant volume being transferred to private wallets. This reduction in potential selling pressure was notable. However, since the end of October, the market has resumed an upward trend driven by ETFs, and the balance on exchange has increased accordingly. This suggests that holders opted to transfer Bitcoin to exchanges in preparation for selling during the uptrend.

In line with our earlier concern highlighted in the research report about the surge in new bitcoin addresses on the chain coinciding with large bitcoin holders closing out positions for profits while retail buyers engage in FOMO-driven purchases, the current data is not entirely encouraging as balances on exchange have rebounded from their August highs. While we don't interpret this as a signal to go short, we are inclined to view any potential pullback as an opportunity to buy at a lower price and await a more significant upward move by the bulls.

Opportunity To Invest

MVRV, or Market Value to Realized Value, serves as a metric to gauge the relationship between a token's market price and its realized value. This comparison sheds light on the supply and demand dynamics of tokens in the market, helping to assess whether a token is undervalued or overvalued. Our investment strategy aligns with a favorable MVRV scenario, specifically when the MVRV 30-day average (MA30) falls below 1.45. Historical data suggests that these instances often present optimal opportunities for long-term Bitcoin holding.

The current MVRV at 1.45 corresponds to the 34,500 level on the chart, identified as the next support area for Bitcoin. As a result, we recommend building a position for around $34,500.

Trading Recommendations

Bitcoin

Futures | Spot

Our short-term trade is still in profits as the dips got bought on Bitcoin. Right now, we believe it could go both ways, so it’s up to you to keep the position open or close it for $2,000 in profits at current prices. The two levels we would watch are the support trendline and the $38,000 resistance. If prices close under the trendline, we recommend getting out of the trade. However, if prices close above $38,000, we are likely to reach our $40,000 target.

Structured Product

Last week, we suggested a very aggressive $35,000 buy-the-dip because we believed that it was strong support. It played out the way we expected and expired out of the money, meaning we received full profits. This week, we suggest a similar strike with a yield of 22%. We suggest a $35,500 Buy-The-Dip with a 4-day duration. $35,500 is the trendline extension level that, if tested, should offer support.